Small Business Payroll Software: Top 5 Essential Picks

Starting your journey with small business payroll software can be a game-changer for your company. If you’re short on time, here’s what you need to know:

- Efficiency: Automates payroll, making it faster and more precise.

- Compliance: Stays updated with tax laws to avoid costly mistakes.

- Integration: Seamlessly works with your existing HR and accounting systems.

- Security: Protects sensitive employee data with robust measures.

Running a small business is no walk in the park. From juggling multiple tasks to ensuring every dollar spent is accounted for, managing payroll efficiently is critical but often overwhelming.

Enter small business payroll software: an essential tool designed to simplify the payroll process. By automating tedious tasks, these systems help reduce errors, improve security, and keep you compliant with tax laws. They also offer features like employee self-service portals, making it easier to manage and access payroll-related data. Investing in the right payroll software can save you precious time and money, allowing you to focus on growing your business.

I’m Dylan Cleppe. With over 20 years of experience in helping businesses streamline their operations, I’ve seen how small business payroll software can transform and simplify crucial payroll processes. With this article, let’s dive deeper into understanding how payroll software can be just the right fit for your business needs.

Important small business payroll software terms:

– automated payroll software

– payroll management system

– manual payroll vs automated payroll

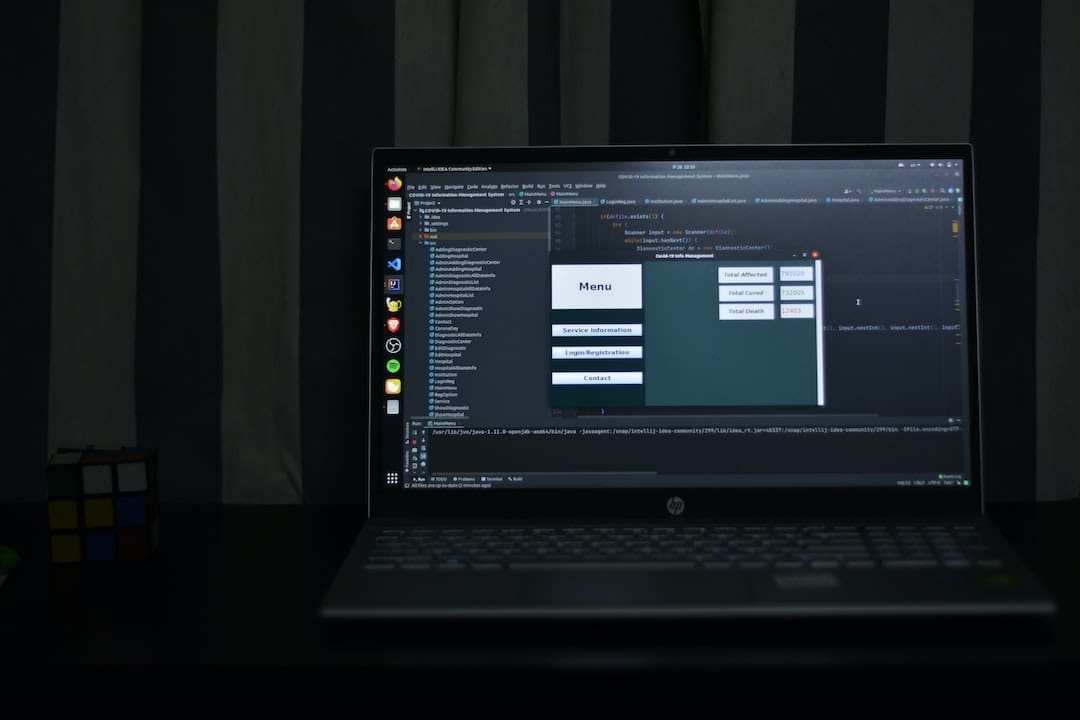

Benefits of Small Business Payroll Software

Efficiency

Imagine cutting your payroll processing time from days to mere minutes. That’s the magic of small business payroll software. Automated systems handle complex calculations and repetitive tasks, freeing up your team to focus on strategic growth. In fact, HR Program Manager Josh Franklin noted a 90% reduction in processing time by using an all-in-one HR system with payroll features.

Accuracy

Payroll errors can be costly and damage employee trust. Automated payroll systems calculate figures like deductions and overtime rates with precision, minimizing human error. This ensures your employees are paid accurately and on time, every time.

Compliance

Keeping up with tax laws is daunting. With over 11,000 tax jurisdictions in the U.S., staying compliant is crucial. Payroll software automatically updates tax rates and regulations, reducing the risk of costly penalties. Paychex and ADP, for example, offer comprehensive compliance features that help you steer complex tax landscapes effortlessly.

Security

Protecting sensitive employee data is non-negotiable. Payroll software uses encryption and other security measures to keep your data safe. With fewer manual inputs, the risk of data breaches and errors is significantly reduced, ensuring peace of mind for both you and your employees.

Employee Self-Service

Empower your employees with self-service options. They can access their pay stubs, update personal information, and manage withholdings online anytime. This reduces the administrative burden on HR and keeps employee records accurate. According to a 2020 survey by the American Payroll Association, 84% of U.S. employees expect instant access to pay and benefits information.

By embracing small business payroll software, you not only streamline payroll processes but also improve efficiency, accuracy, compliance, and security. These tools free up valuable time, allowing you to focus on what matters most—growing your business.

Next, we’ll explore the top payroll software options available for small businesses, comparing features and pricing to help you find the perfect fit.

Top 5 Payroll Software for Small Businesses

When it comes to choosing the right small business payroll software, you need to consider features, pricing, and how well it fits your business needs. Let’s explore the top five options available today.

Paychex Flex

Paychex Flex is a robust payroll solution that offers more than just payroll processing. It’s a full HR platform that covers everything from recruitment to benefits management. Paychex Flex ensures regulatory compliance and offers risk mitigation features. It provides a seamless experience with its self-service tools, allowing employees to manage their own payroll information. The pricing is flexible, catering to businesses of all sizes, and offers a custom solution that can grow with your business.

Gusto

Gusto is known for its user-friendly interface and affordability. It’s designed with small businesses in mind, offering an intuitive experience that simplifies payroll processing. Gusto handles everything from payroll taxes to employee benefits, making it a comprehensive solution. Its pricing structure is straightforward, with plans starting at a base fee plus a per-employee cost. This makes it an affordable choice for startups and growing businesses.

ADP

ADP is a powerhouse in the payroll software industry, known for its comprehensive features and reliable tax filing services. ADP’s platform is highly scalable, making it suitable for businesses of all sizes. It offers seamless integration with other business tools and provides 24/7 support, ensuring that you always have help when you need it. While ADP’s pricing can be on the higher side, the extensive features and support justify the cost for many businesses.

Rippling

Rippling stands out for its automation capabilities and support for international payments. It’s an ideal choice for businesses with global operations or those planning to expand internationally. Rippling automates many HR and payroll tasks, reducing manual work and minimizing errors. Its pricing is competitive, especially for businesses looking for a solution that can handle complex payroll needs across different countries.

Homebase

Homebase is a fantastic option for small businesses looking for a free payroll solution. It offers essential payroll features, including time tracking and scheduling, which are crucial for businesses with hourly employees. Homebase’s free plan is a great starting point, and businesses can upgrade to paid plans for additional features as needed. This makes Homebase an attractive choice for budget-conscious businesses or those just starting out.

Each of these payroll software options offers unique features and pricing structures. Consider what your business needs most—whether it’s comprehensive HR tools, international capabilities, or budget-friendly solutions—and choose the software that aligns best with your goals.

Next, we’ll explore how to choose the right payroll software based on your business needs, budget, and scalability.

How to Choose the Right Payroll Software

Choosing the right small business payroll software can feel overwhelming, but breaking it down into key factors makes it easier. Let’s explore how to find the perfect fit for your business.

Assess Your Business Needs

Start by identifying what your business truly needs. Are you a startup with a handful of employees, or a growing company with complex payroll requirements? Consider:

- Employee Count: Smaller teams might need basic features, while larger teams could require more advanced tools.

- Payroll Frequency: How often do you process payroll? Weekly, bi-weekly, or monthly?

- Additional Features: Do you need time tracking, benefits management, or HR tools?

For example, if you need a full HR suite, consider options that offer comprehensive solutions tailored to your needs.

Budget Considerations

Your budget will play a significant role in your decision. Payroll software costs vary, often based on features and the number of employees. Here’s a quick guide:

- Basic Plans: Ideal for small teams, often include essential payroll features. Look for free options that are great for tight budgets.

- Mid-Range Plans: Include additional features like tax filing and employee benefits. Seek out affordable and user-friendly services.

- Premium Plans: Offer comprehensive features and 24/7 support. Premium solutions with extensive capabilities are available for businesses with more complex needs.

Scalability

Think about the future. Your business might be small now, but what about tomorrow? Choose software that can scale with your growth:

- Flexible Plans: Look for solutions that handle increased complexity as your business expands internationally.

- Upgrade Options: Make sure you can upgrade plans easily as your needs evolve.

Integration Capabilities

Seamless integration with your existing systems is crucial. Consider:

- Accounting Software: Does it sync with your current accounting tools? Ensure the payroll software you choose offers seamless integration.

- HR Systems: If you use separate HR software, ensure your payroll software can integrate without hitches.

By focusing on these key areas—business needs, budget, scalability, and integration—you’ll be better equipped to choose the right payroll software for your small business. Next, we’ll tackle some frequently asked questions about small business payroll software.

Frequently Asked Questions about Small Business Payroll Software

Can I do my own payroll for my small business?

Yes, you can handle payroll yourself, but it comes with challenges. DIY payroll means you’ll manually calculate wages, withhold taxes, and ensure compliance with tax laws. This can be time-consuming and prone to errors, especially if you’re not familiar with payroll regulations.

Many small businesses start with manual payroll but eventually switch to small business payroll software to save time and reduce mistakes. Tools like QuickBooks Online Payroll automate many tasks, making it easier to manage payroll accurately .

What is the best payroll software for a small business?

The best payroll software depends on your specific needs. Here are some top options:

-

Paychex Flex: Offers comprehensive HR tools and payroll processing. It’s ideal for businesses looking for a full HR suite .

-

Gusto: Known for its user-friendly interface and affordability, making it a popular choice for small businesses source.

-

ADP: Offers extensive features and reliable tax filing services, suitable for businesses needing robust support source.

-

Rippling: Great for businesses that need flexibility, especially those with international payroll needs source.

-

Homebase: Provides free payroll services, perfect for startups or small teams with basic needs source.

How much does payroll software cost for small businesses?

The cost of payroll software varies based on features, number of employees, and payroll frequency. Here’s a general breakdown:

-

Basic Plans: Often free or low-cost, like Homebase, which offers essential features without a price tag source.

-

Mid-Range Plans: Typically range from $20 to $50 per month, offering more features like tax filing and employee benefits. Gusto is an example of an affordable mid-range option source.

-

Premium Plans: Can cost $50 or more per month, providing comprehensive features and support. ADP falls into this category, offering extensive capabilities and 24/7 support source.

When considering costs, investing in payroll software can save money by reducing errors and avoiding tax penalties. Evaluate your business needs and budget to find the best fit. Next, we’ll explore how OneStop Northwest can help tailor solutions for your business growth.

Conclusion

Choosing the right small business payroll software is crucial for efficient operations and growth. At OneStop Northwest, we understand that every business has unique needs and challenges. That’s why we offer custom solutions to help you streamline your payroll processes and focus on what truly matters—growing your business.

Why Choose OneStop Northwest?

We specialize in tailoring payroll automation solutions that fit your specific requirements. Whether you’re a startup looking for basic payroll management or an established business needing comprehensive HR and payroll services, we have the expertise to set up and launch the ideal platform for your operations.

Our Commitment to Your Success

Our team is dedicated to ensuring that your transition to automated payroll is seamless and hassle-free. With our support, you’ll benefit from:

-

Increased Efficiency: Automate routine tasks and reduce manual errors, freeing up time to focus on strategic growth initiatives.

-

Improved Compliance: Stay up-to-date with changing tax laws and regulations, minimizing the risk of costly penalties.

-

Scalability: As your business grows, our solutions can scale with you, ensuring you have the tools you need at every stage.

Get Started Today

Ready to take your business operations to the next level? Contact us to learn more about how our custom payroll solutions can drive your business growth. Visit our Payroll Automation page to explore our services and find how we can help you achieve your business goals.

At OneStop Northwest, we’re here to support your journey towards a more efficient and successful business. Let’s work together to find the perfect fit for your payroll needs.