Automated Payroll Processing System: Top 5 Powerful Benefits

Automated payroll processing system: a modern solution that transforms tedious payroll tasks into a seamless, efficient experience.

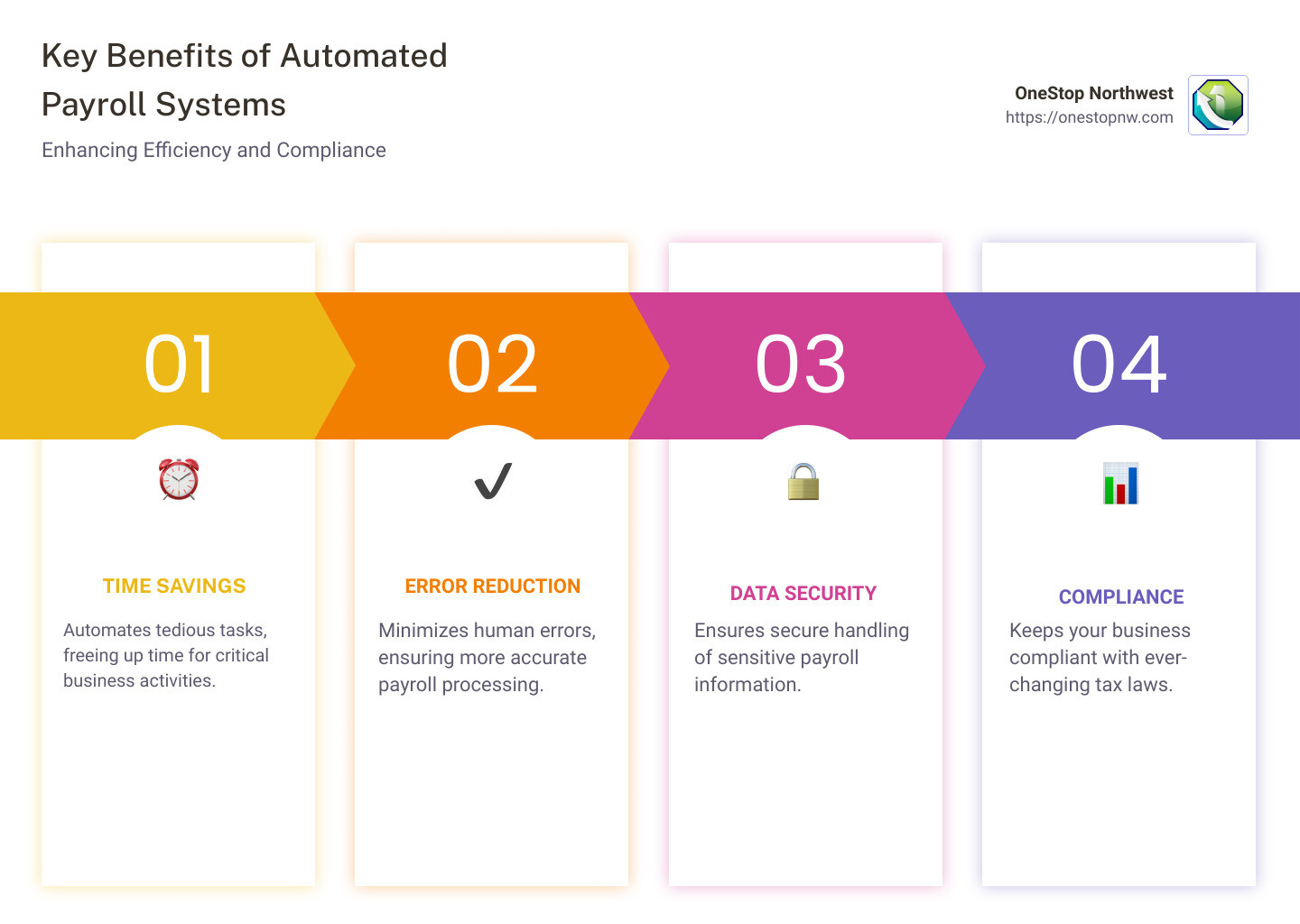

- Why it Matters:

- Saves countless hours of manual work

- Minimizes human errors, ensuring accuracy

- Provides secure handling of sensitive data

- Keeps businesses compliant with tax laws

The backbone of any business is its workforce. Efficiently managing their payroll is not just a task—it’s a cornerstone of business efficiency and employee satisfaction. Imagine manually calculating every paycheck, ensuring compliance with ever-changing tax laws, and securely handling confidential data. This is where an automated payroll processing system becomes invaluable. By replacing manual calculations and paperwork with advanced automation software, businesses can focus more on growth and less on routine administrative tasks.

I’m Dylan Cleppe. With over two decades in customer service and business solutions, I’ve seen how the automated payroll processing system revolutionizes operations. Trust me; it can transform your business’s efficiency.

Automated payroll processing system word list:

– manual payroll vs automated payroll

– payroll automation process

– what is automated payroll

What is an Automated Payroll Processing System?

An automated payroll processing system is a digital solution that simplifies and streamlines the payroll process by using specialized software. Instead of manually handling time-consuming tasks like wage calculations, tax withholdings, and report generation, businesses can rely on automation to take care of these details with precision.

How It Works

Payroll software is at the heart of this system. It handles everything from tracking employee hours to calculating salaries and deductions. The software can also manage direct deposits and ensure compliance with tax regulations. This means fewer mistakes and a lot less stress for HR teams.

Key Benefits

-

Reduced Errors: Human errors are common in manual payroll processes. Automated systems significantly cut down on these mistakes by using precise algorithms to handle calculations.

-

Cost-Saving: While the initial investment in payroll software might seem steep, automation can reduce payroll processing costs by up to 80%, according to the American Payroll Association. This is largely due to the decrease in errors and the efficiency gains.

-

Accurate Timekeeping: Automated systems often include time-tracking features that record employee work hours accurately. This data is directly integrated into the payroll system, ensuring employees are paid correctly for the time they’ve worked.

-

Improved Record-Keeping: With everything stored digitally, businesses can maintain comprehensive and organized records without the clutter of paper files. This makes audits and tax filings much simpler.

-

Compliance: Automated systems help businesses stay up-to-date with tax laws and labor regulations, reducing the risk of penalties.

By leveraging an automated payroll processing system, businesses can focus more on strategic tasks and less on administrative burdens. This not only boosts efficiency but also improves employee satisfaction by ensuring timely and accurate payments.

Benefits of Automated Payroll Processing Systems

Using an automated payroll processing system can transform the way businesses manage their payroll tasks. Let’s explore some of the key benefits:

Reduced Errors

Mistakes in payroll can lead to unhappy employees and potential legal issues. Automated systems minimize these errors by using precise algorithms to handle the complex calculations involved. As a result, businesses can ensure that employees are paid accurately and on time.

Cost-Saving

While the upfront cost of implementing an automated system might seem high, the long-term savings are substantial. According to the American Payroll Association, automation can cut payroll processing costs by up to 80%. This reduction comes from fewer errors and less manual labor.

Accurate Timekeeping

Automated payroll systems often include time-tracking features. These features accurately record employee work hours and integrate this data directly into the payroll system. This ensures that employees are compensated correctly for their hours worked, eliminating discrepancies.

Improved Record-Keeping

Gone are the days of cluttered paper files. With everything stored digitally, automated systems allow for comprehensive and organized record-keeping. This not only simplifies audits and tax filings but also ensures that historical data is easily accessible.

Compliance

Staying compliant with ever-changing tax laws and labor regulations can be challenging. Automated payroll systems keep businesses up-to-date with these requirements, reducing the risk of penalties. They handle tax calculations and filings, ensuring that everything is done correctly and on time.

By adopting an automated payroll processing system, businesses can shift their focus from administrative tasks to more strategic initiatives. This shift not only increases efficiency but also improves employee satisfaction by guaranteeing timely and precise payments.

How to Implement an Automated Payroll Processing System

Implementing an automated payroll processing system can streamline your payroll operations, but it’s crucial to follow a structured approach. Here’s how to make the transition smooth and effective:

Audit Current Processes

Before diving into automation, take a close look at your current payroll processes.

- Identify Pain Points: What takes the most time? Where do errors frequently occur?

- Evaluate Existing Tools: Are there any systems already in place that can be integrated with new software?

This audit will help you understand what you need from an automated system and ensure you select the right features.

Choose the Right Provider

Selecting the best payroll provider is essential. Consider these factors:

- Scalability: Can the system grow with your business?

- Integration: Does it work well with your existing HR and accounting software?

- Cost: Is it within your budget, and does it offer value for money?

Taking advantage of free trials can provide hands-on experience before committing. Comparing various providers will help you find the best fit for your needs.

Data Migration

Data migration is a critical step. Ensure all necessary data is accurately transferred to the new system.

- Collect Employee Data: Gather details such as names, addresses, and bank account information.

- Check for Accuracy: Cleanse data to remove duplicates and outdated information.

- Use Migration Tools: Many payroll systems offer tools to assist with data transfer, making the process more seamless.

Testing

Testing ensures that the new system functions correctly.

- Run Test Payrolls: Conduct trial runs to verify that calculations and processes are accurate.

- Check Integrations: Ensure that the system works smoothly with your other software.

- Gather Feedback: Involve a small group of employees to test the system and provide feedback.

Testing helps identify any issues early, allowing you to address them before fully launching the system.

By following these steps, you can implement an automated payroll processing system that improves efficiency and accuracy in your payroll operations. Next, we’ll explore some of the top automated payroll processing systems available to help you make an informed choice.

Top Automated Payroll Processing Systems

Choosing the right automated payroll processing system is vital for streamlining your payroll tasks. Let’s explore some of the top systems available today: Gusto, ADP, Paychex, Rippling, and Deel.

Gusto

Gusto is a popular choice for small to mid-sized businesses. It’s known for its user-friendly interface and comprehensive HR tools. Gusto offers full-service payroll, including tax filings, benefits administration, and time tracking integration.

- Pros: Unlimited payroll runs; easy-to-use interface; integrates with major accounting software like QuickBooks and Xero.

- Cons: Customer service hours are limited; longer processing times on lower-tier plans.

ADP

ADP is a well-established name in payroll automation, suitable for businesses of all sizes. It offers robust payroll calculations, tax management, and a wide range of integrations with HR and financial software.

- Pros: Scalable as businesses grow; extensive third-party integrations; add-ons for time tracking and employee benefits.

- Cons: Inconsistent user interface; limited reporting capabilities.

Paychex

Paychex is designed for businesses looking for a customizable payroll solution. It provides features like payroll processing, tax compliance, and employee benefits management.

- Pros: Customizable solutions; strong customer support; comprehensive HR services.

- Cons: Pricing can be higher than some competitors; may have a steeper learning curve for new users.

Rippling

Rippling stands out with its integrated approach, combining HR, IT, and finance solutions. It’s ideal for companies that want to manage payroll alongside other employee-related functions.

- Pros: Over 500 integrations; custom workflows and reporting; manages payroll, PTO, and benefits in one platform.

- Cons: Less robust for global payroll; state taxes require an additional package.

Deel

Deel is perfect for businesses with a global workforce. It offers global payroll and contractor management, supporting multiple payment methods and currencies.

- Pros: 24/7 live support; supports hiring and contractor management in over 100 countries; multiple payment options including cryptocurrency.

- Cons: Limited accounting integrations; no native time-tracking feature; priced per employee.

Each of these systems has unique strengths, so consider your company’s specific needs and priorities when making a choice. Whether you need a system that integrates seamlessly with existing software or one that supports a global team, there’s an option that will fit your requirements.

Next, we’ll tackle some frequently asked questions about automated payroll processing systems to help you further understand their capabilities and applications.

Frequently Asked Questions about Automated Payroll Processing Systems

What are automated payroll systems?

An automated payroll system is a software solution that simplifies the process of paying employees. It automates tasks like calculating wages, withholding taxes, and distributing payments. This technology reduces human error and saves time, making payroll management more efficient. By handling routine tasks, it allows HR teams to focus on more strategic activities.

Is ADP an automated payroll system?

Yes, ADP is a well-known name in payroll automation. It offers comprehensive payroll solutions for businesses of all sizes. ADP automates payroll calculations, tax deductions, and compliance, integrating seamlessly with various HR and financial systems. This makes it a popular choice for companies looking to streamline their payroll processes.

How do you automate payroll payments?

Automating payroll payments involves several steps:

-

Choose a Payroll Provider: Select a provider that meets your business needs. Consider factors like scalability, integration capabilities, and cost.

-

Data Migration: Transfer employee data, including personal details, salary information, and tax withholdings, to the new system. Ensure accuracy to prevent errors.

-

Integration: Ensure the payroll system integrates with your existing HR and accounting software. This helps in maintaining a seamless flow of information.

-

Set Up Direct Deposit: Configure direct deposit settings so employees receive their pay directly into their bank accounts. This is a key feature of most automated payroll systems.

-

Testing: Before going live, conduct a test run to identify and resolve any issues. This step ensures smooth operation when the system is fully implemented.

By following these steps, businesses can efficiently automate their payroll payments, reducing manual work and enhancing accuracy.

Conclusion

In today’s business environment, automating payroll is no longer a luxury—it’s a necessity. Here at OneStop Northwest, we recognize the transformative power of an automated payroll processing system. Our mission is to simplify your payroll journey, allowing you to focus on what truly matters: growing your business.

Why Choose OneStop Northwest?

We offer a comprehensive suite of business solutions custom to your needs. From payroll automation to HR outsourcing, our services are designed to improve efficiency and accuracy across your operations. Located in Union, Washington, and serving a broad region, we are committed to delivering excellence and ensuring your business runs smoothly.

Key Benefits of Our Payroll Automation Services:

-

Reduced Errors: Automated systems minimize human errors, ensuring accurate and timely payroll processing.

-

Cost Savings: By streamlining payroll tasks, businesses save time and resources, which directly impacts the bottom line.

-

Compliance Made Easy: Our systems help manage tax filings and compliance, reducing the risk of penalties.

Ready to Transform Your Payroll Process?

Let us guide you through the transition to a more efficient payroll system. Visit our Payroll Automation Services page to learn more about how we can support your business.

Automation is the future, and the future is now. Don’t get left behind. Partner with OneStop Northwest and experience the benefits of payroll automation firsthand.