Automated Payroll System: Top 5 Powerful Solutions 2025

Mastering Payroll: Why Automated Systems are Key for Your Business

An automated payroll system is a game-changer for businesses looking to streamline their operations and save time. At its core, such a system automates the complex tasks of managing employee pay, ensuring accurate timekeeping, and staying compliant with tax laws. With features like direct deposit, tax management, and error reduction, it’s a must-have for modern business efficiency.

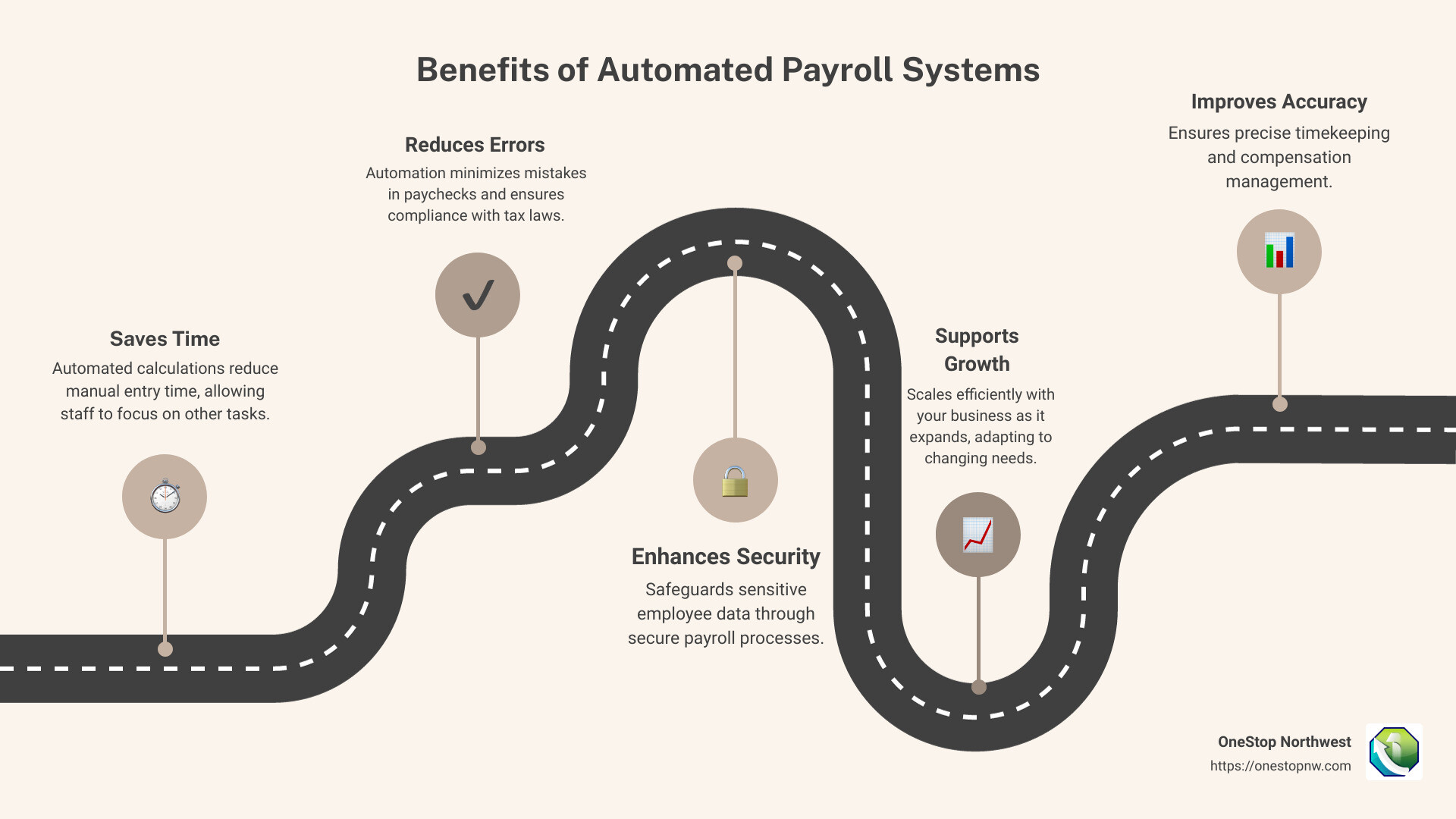

- Saves Time: Automated calculations reduce manual entry.

- Reduces Errors: Minimizes mistakes in paychecks and compliance.

- Improves Security: Safeguards sensitive employee data.

- Supports Growth: Scales easily as your business expands.

In today’s competitive landscape, running a business means juggling various operational challenges, and payroll management is at the forefront. Accurate and timely payroll is crucial—it’s not just about paying employees but also about complying with complex tax regulations. Many small business owners struggle with manual payroll processes that consume valuable time and are prone to errors.

I am Dylan Cleppe, passionate about providing solutions that help businesses thrive. With over 20 years in customer service and experience in payroll automation through my company, OneStop Northwest, I’ve seen how transitioning to an automated payroll system can revolutionize operations. Let’s dive deeper into the benefits and setup process of these systems.

Automated payroll system terms to remember:

– manual payroll vs automated payroll

– payroll automation process

– why automate payroll

Understanding Automated Payroll Systems

An automated payroll system is a digital solution that streamlines the payroll process by automating tasks such as calculating wages, deducting taxes, and distributing payments. It replaces manual methods, which often involve spreadsheets or paper-based systems, with software that handles these tasks efficiently and accurately.

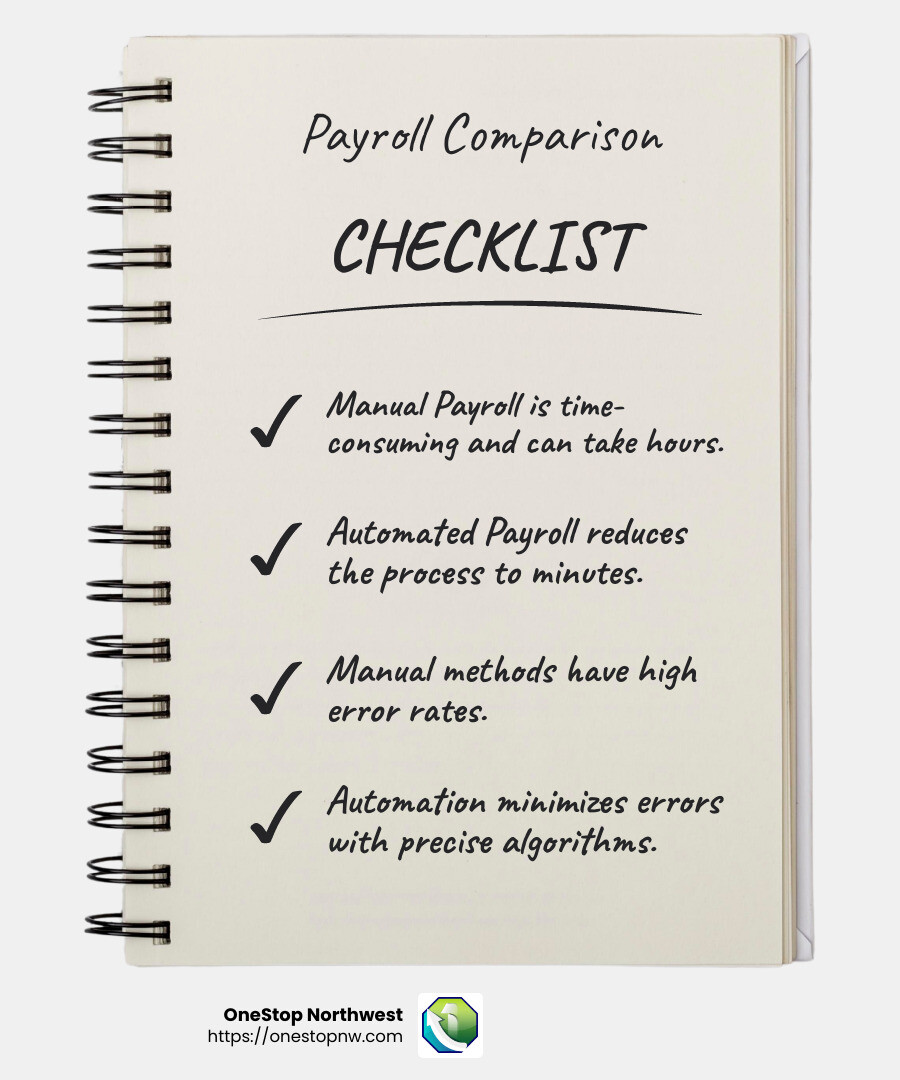

Manual vs. Automated Payroll

Manual Payroll:

- Time-Consuming: Requires entering data by hand, which can take hours, especially for larger businesses.

- Error-Prone: The risk of mistakes is high. Even a small error can lead to significant financial discrepancies.

- Limited Scalability: As a business grows, managing payroll manually becomes increasingly difficult and inefficient.

Automated Payroll:

- Efficient: Automates repetitive tasks, reducing the time spent on payroll from hours to minutes.

- Accurate: Uses algorithms to ensure precise calculations, minimizing errors.

- Scalable: Easily adapts to the needs of growing businesses without requiring additional resources.

Benefits of Payroll Software

1. Reduced Errors:

Automated systems drastically cut down on human errors. They handle complex calculations and tax withholdings automatically, ensuring employees are paid correctly and on time.

2. Accurate Timekeeping:

These systems often integrate with time and attendance software, making it easy to track employee hours and ensure accurate pay.

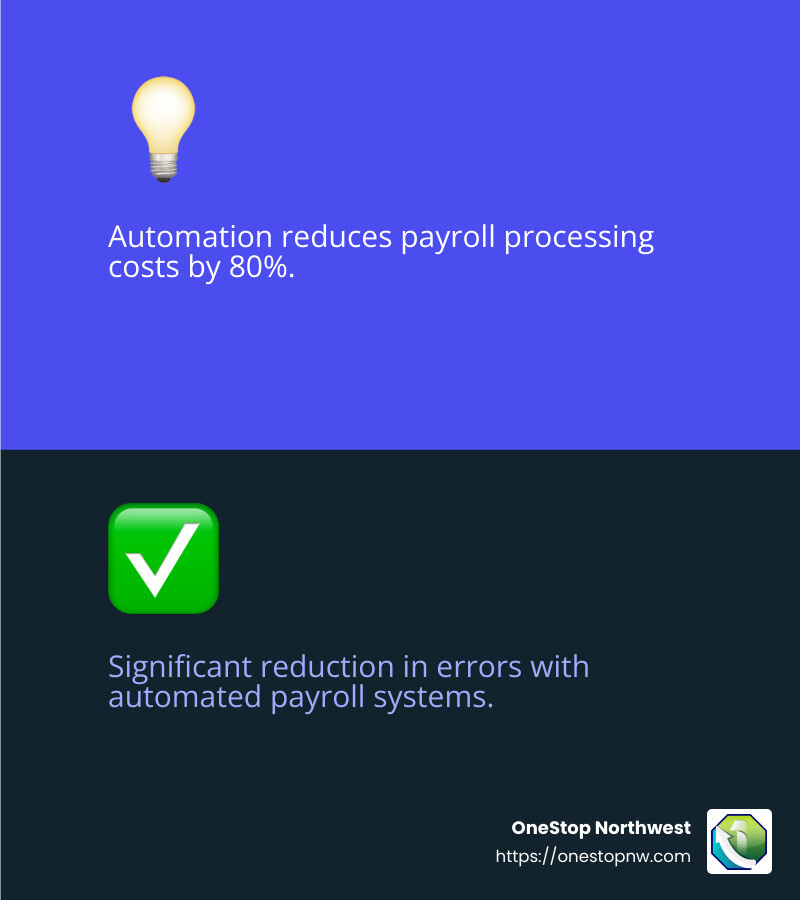

3. Cost-Saving:

While the initial investment might seem high, automation can reduce payroll processing costs by up to 80%, according to the American Payroll Association.

4. Record-Keeping and Compliance:

An automated system stores all payroll data digitally, making it easy to access past records and stay compliant with tax laws and regulations.

5. Direct Deposit and Tax Management:

Employees can receive payments directly into their bank accounts, and the system automatically calculates and withholds the correct taxes, reducing the risk of compliance issues.

By moving to an automated payroll system, businesses can not only save time and reduce costs but also improve accuracy and compliance. This transition is crucial for any business looking to optimize its operations and support growth.

Next, we’ll explore the key features of an automated payroll system and how they can further improve your business operations.

Key Features of an Automated Payroll System

Switching to an automated payroll system can transform how your business handles payroll. Let’s explore the key features that make these systems essential for modern businesses.

Reduced Errors

One of the standout benefits of automation is the significant reduction in errors. Manual payroll processing is prone to mistakes, which can lead to incorrect paychecks and unhappy employees. With automation, complex calculations, including bonuses and deductions, are handled by the software, ensuring accuracy every time.

Accurate Timekeeping

Automated payroll systems often integrate seamlessly with time and attendance tools. This integration means employee hours are recorded accurately and automatically transferred to payroll. No more manual entry or guesswork. Employees clock in and out electronically, and the system does the rest, ensuring everyone is paid for their actual hours worked.

Cost-Saving

While there might be an initial cost to set up an automated system, the savings in the long run are substantial. The American Payroll Association notes that automation can reduce payroll processing costs by 80%. This reduction comes from fewer errors and less need for a large payroll team.

Improved Record-Keeping

Keeping track of payroll records is crucial for compliance and audit purposes. Automated systems store all data digitally, making it easy to access and organize. This digital record-keeping reduces office clutter and ensures you have all the necessary information at your fingertips, should you need it.

Direct Deposit

Say goodbye to paper checks. Automated systems offer direct deposit, ensuring employees receive their pay directly into their bank accounts. This feature not only speeds up the payment process but also improves employee satisfaction by ensuring timely payments.

Tax Management

Taxes can be a complicated aspect of payroll, but automated systems simplify this process. They automatically calculate withholdings and ensure compliance with local, state, and federal tax laws. This automation reduces the risk of costly errors and missed deadlines, keeping your business on the right side of the law.

By implementing these features, an automated payroll system helps businesses streamline operations, reduce costs, and improve overall efficiency. Next, we’ll guide you through the steps to set up an automated payroll system for your business.

How to Set Up an Automated Payroll System

Setting up an automated payroll system can seem daunting, but breaking it down into manageable steps makes the transition smooth and efficient. Here’s a simple guide to get you started:

1. Audit Current Processes

Before diving into automation, take a close look at your current payroll processes. Identify pain points and areas that need improvement. This audit will help you understand what features you need in a new system and ensure you choose the right solution for your business.

Questions to consider:

– Are there frequent errors in payroll calculations?

– How long does payroll processing take each cycle?

– Are you struggling with compliance or tax management?

2. Choose a Payroll Provider

With your audit complete, it’s time to select a payroll provider. Compare different vendors based on features, pricing, and customer reviews. Consider if the system can scale with your business and integrates well with your existing HR tools.

Top Providers to Consider:

– Gusto: Known for its user-friendly interface and HR tools.

– ADP: Offers robust features and scalability.

– Paychex: Provides comprehensive HR solutions.

Tip: Take advantage of free trials to test out systems before committing.

3. Data Migration

Once you’ve chosen a provider, the next step is migrating your payroll data. This includes employee information, salary details, and historical payroll records. Ensure all data is accurate and up-to-date to avoid errors.

Steps for Data Migration:

– Gather Data: Collect all necessary payroll information.

– Cleanse Data: Remove duplicates or outdated entries.

– Transfer Data: Use the tools provided by your payroll software to transfer data securely.

4. Testing

Before going live, run tests to ensure everything works as expected. This includes verifying data accuracy and testing integration with existing systems like HR and accounting software.

Testing Checklist:

– Conduct test payroll runs to check calculations.

– Ensure data flows correctly between integrated systems.

– Verify that all employee data is accurate.

5. Employee Self-Service

One of the benefits of automated payroll systems is employee self-service. This feature allows employees to access their pay information, update personal details, and more, reducing the administrative burden on your HR team.

Benefits of Self-Service:

– Employees can view pay stubs and tax documents online.

– Reduces HR workload by allowing employees to manage their own information.

– Improves employee satisfaction by providing easy access to important data.

By following these steps, you can successfully implement an automated payroll system that streamlines your payroll processes, reduces errors, and saves time. Next, we’ll explore some of the top automated payroll systems available today.

Top Automated Payroll Systems

Choosing the right automated payroll system is crucial for your business. Let’s explore some of the top options available, each offering unique features to meet different needs.

Gusto

Gusto is a popular choice for small to medium-sized businesses. It’s known for its user-friendly interface and a wide range of HR tools. Gusto offers unlimited payroll runs, which means you can process payroll as often as needed without worrying about extra costs. However, be aware that the most affordable plan comes with a 4-day payroll processing time.

Pros:

– Unlimited payroll runs

– User-friendly interface

– Extensive HR tools

Cons:

– Limited customer service hours

– Longer processing time on the basic plan

ADP

ADP, or Automatic Data Processing, is a well-known name in the payroll world. It offers robust features and scalability, making it suitable for businesses of all sizes. ADP’s platform includes a self-service portal for employees, which improves convenience and reduces administrative tasks.

Pros:

– Comprehensive payroll and HR solutions

– Scalable for growing businesses

– Self-service portal for employees

Cons:

– Generally higher cost compared to competitors

– Pricing quotes are only available online

Paychex

Paychex provides a flexible range of plans that can be custom to your business needs. It’s particularly strong in offering HR solutions alongside payroll, making it a great choice if you’re looking for a comprehensive package. However, new users might experience a learning curve.

Pros:

– Customizable plans with HR basics included

– Strong focus on compliance and risk mitigation

Cons:

– Potential learning curve for new users

– No self-service sign-up option

Paycom

Paycom is another top contender, especially for businesses looking to reduce time spent on payroll processing. Their innovative Beti feature has been shown to cut payroll processing time by 88%. Paycom also offers a variety of resources to help businesses automate HR processes effectively.

Pros:

– Significant reduction in payroll processing time

– Comprehensive HR automation tools

Cons:

– May be more suitable for larger businesses

OneStop Northwest

OneStop Northwest stands out for its seamless integration capabilities, allowing businesses to connect with existing HR and accounting tools. This system ensures that all your business processes are connected and streamlined, offering scalability to grow with your business.

Pros:

– Strong integration with other business platforms

– Scalable solutions custom to unique business needs

Cons:

– Specific details on pricing and features may require direct inquiry

These providers offer a range of features and pricing options to fit different business needs. Whether you’re looking for an easy-to-use interface, comprehensive HR tools, or strong integration capabilities, there’s an automated payroll system that can help streamline your processes and improve efficiency.

Frequently Asked Questions about Automated Payroll Systems

What is an automated payroll system?

An automated payroll system is a software solution that handles payroll processes with minimal human intervention. It automates tasks like calculating wages, managing deductions, and processing payments. This system pulls data from various sources, such as employee hours, benefits, and tax information, to ensure accurate and timely payroll processing.

How do you automate payroll payments?

To automate payroll payments, start by auditing your current processes. Identify manual tasks that can be automated, like data entry and calculation of deductions. Next, choose a payroll provider that suits your business needs. Consider factors like scalability, integration with existing systems, and cost.

Once you’ve selected a provider, migrate your data into the new system. This includes employee details, salary information, and tax data. Testing is crucial to ensure the system works correctly and processes payments accurately. Finally, enable employee self-service features, allowing staff to access their pay information and manage benefits online.

What is the difference between manual and automated payroll?

Manual payroll involves calculating employee pay and deductions by hand, often using spreadsheets. This process is time-consuming and prone to errors due to human involvement. It also requires keeping up with tax laws and regulations manually, increasing compliance risks.

In contrast, an automated payroll system uses software to perform these tasks. It automates calculations, tax compliance, and reporting, reducing the likelihood of errors. Automated systems offer features like direct deposits and electronic record-keeping, making them efficient and reliable.

By understanding these differences, businesses can make informed decisions when choosing between manual and automated payroll systems.

Conclusion

Switching to an automated payroll system offers a multitude of benefits that can transform your business operations. By reducing errors, saving time, and cutting costs, payroll automation not only streamlines HR functions but also improves overall business efficiency.

Reduced Errors: Automation minimizes human error. Once data is correctly entered, the system handles calculations and updates seamlessly, ensuring accuracy in every payroll cycle.

Time and Cost Savings: Automated systems reduce the need for manual data entry and complex calculations, freeing up HR teams to focus on strategic tasks. Companies like Paycom have reported an 88% reduction in payroll processing time, demonstrating significant efficiency gains.

Improved Record-Keeping and Compliance: Automated payroll systems offer robust record-keeping capabilities. They can easily generate reports for audits and compliance checks, reducing the administrative burden on HR teams.

At OneStop Northwest, we are committed to helping businesses like yours harness the power of payroll automation. Our comprehensive services ensure a smooth transition to a more efficient and accurate payroll process. We offer custom solutions that integrate seamlessly with your existing systems, enhancing your business operations.

Don’t get left behind in the digital age. Accept payroll automation with OneStop Northwest and experience the benefits firsthand. For more information on how we can help you automate your payroll system and boost your business efficiency, visit our Payroll Automation Services.

By choosing to automate, you are investing in the future of your business. Let us guide you on this journey to a more streamlined and effective payroll process.