Automated Payroll Software: Top 5 Powerful Solutions

Automated payroll software is changing how businesses handle payroll, making the process faster, more accurate, and efficient. This software eliminates the manual tasks traditionally associated with processing payroll. Here’s a quick look at how it can benefit you:

- Time-Saving: Automating payroll can drastically cut processing time, freeing up your schedule for more strategic tasks.

- Cost-Effective: Streamlining payroll processes can reduce operational costs over time and minimize the need for additional staff.

- Error Reduction: Automated systems minimize human errors, ensuring employees are paid correctly.

- Compliance: Keeping up with tax laws is easier with automated updates and reporting features.

Adopting automated payroll software means businesses can focus more on growth instead of getting bogged down by tedious payroll tasks. Companies of all sizes are finding this transition not just beneficial, but essential for staying competitive and compliant.

I’m Dylan Cleppe, and I’ve spent decades helping businesses like yours streamline their operations with innovative solutions like automated payroll software. My experience in building successful business systems ensures we will find the perfect software to fit your needs, enhancing both efficiency and productivity.

Basic automated payroll software terms:

Understanding Automated Payroll Software

Automated payroll software revolutionizes how businesses manage their payroll processes, making them more efficient and less prone to errors. By automating complex tasks, this software ensures that payroll is processed swiftly and accurately.

What is Automated Payroll Software?

Automated payroll software is designed to handle the calculation of wages, tax withholdings, and payment distribution. It replaces manual processes with digital solutions, ensuring that payroll is processed accurately and on time, every time.

Key Features of Payroll Systems

-

Automated Calculations: The software automatically calculates wages, taxes, and deductions, significantly reducing the chances of errors.

-

Integration with HR: Many systems offer seamless integration with HR software, allowing you to manage payroll, benefits, and employee data from a single platform.

-

Compliance Management: Stay up-to-date with federal, state, and local tax regulations. Automated systems ensure compliance by updating tax codes and generating necessary forms like W-2s and 1099s.

Benefits of HR Integration

Integrating payroll systems with HR software offers numerous benefits:

-

Unified Data Management: Manage employee information, time tracking, and payroll in one place, eliminating the need to enter the same data multiple times, reducing errors and saving time.

-

Improved Reporting: Generate comprehensive reports that combine payroll and HR data, aiding in strategic planning and decision-making.

-

Improved Employee Experience: Employees can access their pay slips, tax forms, and benefits information online, enhancing transparency and satisfaction.

Real-World Impact

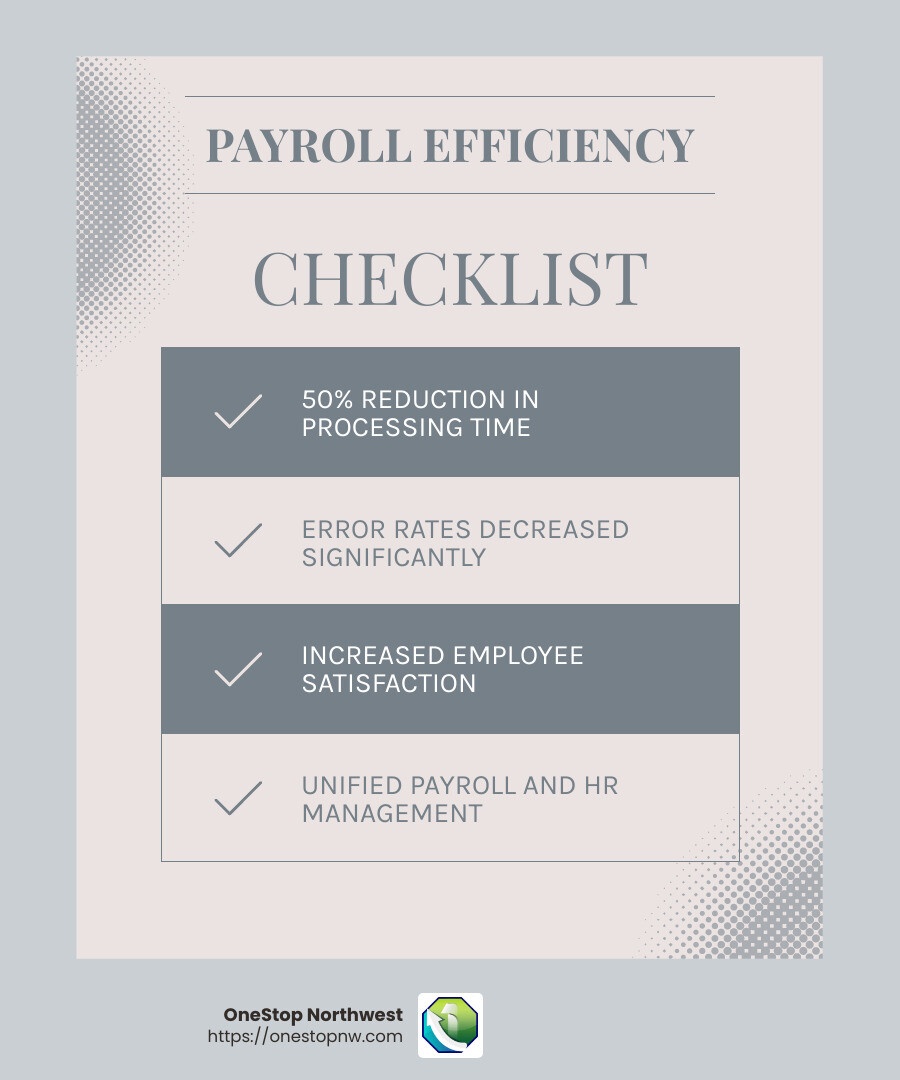

Consider the case of a small business using QuickBooks Payroll. By integrating their payroll and HR systems, they reduced payroll processing time by 50% and cut down on errors, leading to happier employees and a more efficient operation.

Automated payroll software is not just a tool; it’s a strategic asset that can transform your business operations. By integrating with HR systems, it provides a comprehensive solution that supports both payroll and human resource management, paving the way for a more efficient and compliant business environment.

Top Automated Payroll Software Solutions

When it comes to automated payroll software, there are several standout options that cater to businesses of all sizes. These tools not only streamline payroll processes but also ensure compliance and reduce the potential for errors. Let’s explore some of the top solutions available today.

ADP

ADP is a leader in payroll automation, known for its robust features and seamless integration with HR systems. ADP offers solutions like RUN Powered by ADP® for small businesses and ADP Workforce Now® for larger organizations. These platforms provide automated payroll processing, tax filing, and compliance management. ADP’s software ensures that all payroll tasks are handled efficiently, allowing business owners to focus on growth rather than administrative tasks.

QuickBooks Payroll

QuickBooks Payroll is ideal for businesses already using QuickBooks for accounting. Its seamless integration allows for easy management of payroll alongside other financial data. QuickBooks Payroll automates salary calculations, tax deductions, and payroll tax filings. It also offers flexible payment options, such as direct deposit, and updates tax tables automatically to maintain compliance. This makes it a go-to choice for businesses looking to streamline their financial operations.

Paychex Flex

Paychex Flex provides a comprehensive HR solution that covers everything from recruitment to payroll and benefits management. Known for its straightforward interface, Paychex Flex ensures regulatory compliance and offers personalized support. The platform is designed to adapt to the needs of businesses of all sizes, making it a versatile choice for companies looking to manage their entire employee lifecycle efficiently.

Rippling

Rippling is perfect for businesses that require flexibility and adaptability in their payroll systems. It integrates payroll with other HR functions, allowing for a unified approach to employee management. Rippling is designed to handle the complexities of modern business environments, making it suitable for companies with remote or hybrid workforces. Its user-friendly interface and comprehensive features make it a popular choice for growing businesses.

Gusto

Gusto is renowned for its user-friendly platform that simplifies payroll processing for small and medium-sized businesses. It offers automated payroll, benefits administration, and compliance management. Gusto makes it easy for businesses to manage payroll taxes and employee benefits, all from one place. The platform is designed to improve the employee experience by providing easy access to pay slips and benefits information.

These automated payroll software solutions are designed to make payroll processing more efficient and less error-prone. Whether you’re a small business owner or managing a larger organization, these tools offer the features and flexibility needed to streamline your payroll operations and ensure compliance with ever-changing regulations.

Benefits of Using Automated Payroll Software

Automated payroll software offers a host of benefits that can transform the way businesses manage their payroll processes. Let’s explore the key advantages that make these tools indispensable for modern businesses.

Cost Reduction

One of the most significant benefits of automated payroll software is cost reduction. By automating labor-intensive tasks, businesses can reduce the number of hours spent on manual payroll processing. This means fewer resources are needed to handle payroll, allowing companies to allocate their budget more effectively. Moreover, by minimizing errors, businesses save money on potential fines and penalties that can arise from inaccurate payroll calculations.

Error Reduction

Human errors in payroll can be costly and damaging to employee trust. Automated systems drastically reduce the likelihood of mistakes by handling complex calculations, like tax withholdings and overtime pay, with precision. According to reports, automation can cut processing time by 90%, ensuring that employees receive their correct pay on time and fostering trust within the organization.

Compliance

Staying compliant with federal, state, and local regulations is crucial for any business. Automated payroll software keeps track of ever-changing tax laws and labor regulations, ensuring that all payroll processes remain compliant. This reduces the risk of non-compliance penalties and offers peace of mind to business owners. For example, OneStop Northwest’s payroll solutions provide timely compliance updates, so businesses are always up-to-date with the latest legislative changes.

Time-Saving

Time is a valuable resource, and automated payroll software helps businesses save significant amounts of it. By automating repetitive tasks like wage calculations and tax filings, businesses can focus on more strategic activities. This is particularly beneficial for small businesses, where every minute counts. Automated systems also offer real-time insights and reporting, allowing businesses to make informed decisions quickly.

In summary, adopting automated payroll software can lead to substantial improvements in efficiency, accuracy, and compliance. These tools not only streamline payroll processes but also empower businesses to focus on growth and innovation without getting bogged down by administrative tasks.

Next, we will explore how to choose the right automated payroll software for your business needs.

How to Choose the Right Automated Payroll Software

Selecting the right automated payroll software can be a game changer for your business. Here’s how to make an informed choice:

Business Size

First, consider the size of your business. Small businesses might benefit from simple solutions like Gusto, which offers ease of use and basic features. Larger companies may require more robust tools like ADP or Paychex Flex that can handle complex payroll needs and scale as the business grows.

Key Questions:

- How many employees do you have?

- Will the software meet your current needs and scale with your growth?

Integration

Your payroll software should seamlessly integrate with your existing systems, such as HR and accounting software. This ensures all your business processes are connected and streamlined. For instance, QuickBooks offers seamless integration with its accounting software, making it a unified platform for both payroll and accounting tasks.

Consider:

- Does the software integrate with your current HR and accounting systems?

- Can it connect with other tools you use, like time-tracking apps?

User-Friendliness

A user-friendly interface is essential, especially if your team lacks extensive technical expertise. Look for software with an intuitive layout that makes navigation easy. OneStop Northwest, for example, is praised for its easy-to-steer interface, which is ideal for businesses without extensive accounting experience.

Think About:

- Is the software easy to use?

- How steep is the learning curve?

Support

Robust customer support can be a lifesaver when you encounter issues. Look for providers that offer 24/7 support and have multiple support channels, like phone, email, and chat. Paychex Flex is known for providing personalized support, ensuring you get the help you need when you need it.

Questions to Ask:

- What kind of support does the software offer?

- Are there resources like FAQs, tutorials, or user forums?

By focusing on these key factors, you can choose the right automated payroll software that aligns with your business needs, improves efficiency, and supports your growth.

Next, we’ll address some frequently asked questions about automated payroll software, including its benefits and how it works online.

Frequently Asked Questions about Automated Payroll Software

Is there a way to automate payroll?

Absolutely! Automated payroll software like ADP and Paychex Flex makes managing payroll a breeze. These systems automate complex tasks such as calculating wages, handling tax withholdings, and even filing taxes. ADP, for instance, offers seamless integration with HR tools, ensuring that your payroll processes are not only automated but also connected to other essential business functions.

Key Features of Automated Payroll Software:

- Tax Withholdings: Automatically calculate and withhold taxes, reducing the risk of errors.

- Integration: Sync with HR and accounting systems for a unified approach.

What are the benefits of payroll automation?

Automating payroll comes with several significant benefits:

1. Cost Savings: By automating payroll, businesses can reduce processing costs by up to 80%, as noted by the American Payroll Association. This is because automation minimizes manual data entry and the need for a large payroll team.

2. Error Reduction: Automated systems drastically reduce human errors, ensuring accurate calculations for deductions and overtime. This leads to more precise paychecks and happier employees.

3. Compliance: Stay compliant with tax laws effortlessly. Software like ADP and Paychex Flex generates necessary reports and updates you on regulatory changes, helping avoid costly penalties.

4. Time-Saving: Save hours each pay period by letting the software handle routine tasks like direct deposits and tax filings. This time can be redirected to more strategic business activities.

Can I do payroll online?

Yes, you can! Many automated payroll solutions offer online services, allowing you to manage payroll from anywhere. Paychex Flex is an excellent example, providing mobile access so you can run payroll on the go. This flexibility is perfect for businesses of all sizes, especially those with remote or distributed teams.

Online Payroll Services:

- Accessibility: Manage payroll from any device with internet access.

- Convenience: Run payroll anytime, anywhere, with cloud-based solutions.

By leveraging automated payroll software, businesses can streamline operations, save costs, and ensure accuracy in their payroll processes. In the next section, we’ll conclude by exploring how OneStop Northwest offers comprehensive solutions to improve business efficiency.

Conclusion

At OneStop Northwest, we understand the challenges businesses face when managing payroll. That’s why we offer comprehensive solutions designed to streamline your payroll processes, boost efficiency, and reduce costs. Our services are custom to meet the unique needs of your business, ensuring that you have the tools you need to succeed.

Business Efficiency through Automation:

Automating payroll with our expert solutions can transform your business operations. By reducing manual tasks, you can focus on what truly matters—growing your business. Our automated payroll software integrates seamlessly with your existing systems, ensuring a smooth transition and minimal disruption.

Why Choose OneStop Northwest?

- Custom Solutions: We customize our services to fit your specific requirements, whether you’re a small startup or a large corporation.

- Expert Support: Our team is here to guide you every step of the way, providing support and advice to maximize your payroll efficiency.

- Advanced Integration: Our systems work in harmony with your HR and accounting software, creating a unified and efficient workflow.

Join us at OneStop Northwest and experience the benefits of payroll automation firsthand. Let us help you improve your business operations with our expert payroll automation solutions. Don’t get left behind—accept the future of payroll today.